Not for distribution directly or indirectly in the United States, Canada, Australia or Japan

Exclusive Networks announces successful initial public offering on Euronext Paris

Key highlights

- Exclusive Networks is a leading global specialist in innovative cybersecurity technologies.

- Global offering of approximately 366 million euros, and up to approximately 421 million euros in case of full exercise of the over-allotment option.

- The Offering is made of (i) an issuance of shares by Exclusive Networks amounting to approximately 260 million euros and (ii) a sale of shares by existing shareholders amounting to approximately 106 million euros which may be increased to approximately 161 million euros if the over-allotment option is exercised in full.

- Offer price set at 20 euros per share, implying a market capitalisation of approximately 1.8 billion euros.

- Strong demand from high quality institutional investors, in France and abroad.

- Exclusive Networks shares will start trading on the regulated market of Euronext Paris, compartment A, on September 23, 2021 on a when-issued basis (“promesses d’actions”).

Paris, 22 September 2021 – Exclusive Networks S.A. (“Exclusive Networks” or the “Company”, ticker symbol EXN), a leading global specialist in innovative cybersecurity technologies, announces the success of its Initial Public Offering (IPO) in view of the admission of its shares to trading on the regulated market of Euronext Paris (Compartment A, ISIN code FR0014005DA7, ticker symbol EXN).

The success of the Offering reflects strong demand from leading French and international institutional investors. Based on the offering price of 20 euros per share, the market capitalisation of Exclusive Networks would amount to approximately 1.8 billion euros.

Jesper Trolle, Chief Executive Officer of Exclusive Networks, said:

“Cybersecurity has never been more relevant – to business leaders, state heads and consumers. Exclusive Networks has a mission to drive the transition to a totally trusted digital future. Our IPO is a natural step in our evolution and will accelerate our simple, proven strategy: to extend our international reach, expand our services offering and add value to our existing customer and vendor relationships. It will also enable us to continue acquiring companies that complement our culture, capabilities and reach.

We will continue investing in our talented cybersecurity specialist teams, who are the key to our success. I would like to personally thank not just our people, but also the vendors and channel partners we work with every day. None of this would be possible without their commitment to innovation, which has driven Exclusive Networks’ growth from a small private company two decades ago to the global cybersecurity specialist we are today – and a 36% gross sales CAGR since 2013. We plan to continue to capture the long-term growth drivers in the cyber market, and our IPO is an important step for us to achieve that goal.”

About Exclusive Networks

Exclusive Networks is a leading global specialist in innovative cybersecurity technologies, providing services to accelerate the sale of cybersecurity disruptive and digital infrastructure technologies on a global scale. Exclusive Networks helps cybersecurity vendors scale their businesses globally, and offering channel partners (such as value-added resellers, system integrators, telcos and managed service providers) expertise, disruptive technologies and services to fit the needs of their corporate customers. Exclusive Networks also works with several vendors offering solutions in specific sub-segments beyond cyber.

Exclusive Networks excels by combining global scale with local execution. With offices in 40 countries and the ability to service customers across five continents and in over 150 countries, Exclusive Networks, headquartered in France, offers a “global scale, local sale” model. This model enhances performance in local operations by providing both global and local support. This approach has enabled Exclusive Networks to (i) develop one of the world’s broadest portfolios of cybersecurity solutions from over 240 leading vendors and (ii) develop a worldwide customer base, consisting of over 18,000 VARs, SIs, Telcos and MSPs, indirectly serving more than 110,000 end-customers. Over the period from 2018 to 2020, Exclusive Networks engaged in business in more than 124 countries.

Exclusive Networks’ approach enables vendors to adopt a simple and agile go-to-market model in relation to their cybersecurity and digital infrastructure solutions, while benefitting from Exclusive Networks’ local expertise and market knowledge in each jurisdiction where it operates. Exclusive Networks’ scale is equally important to its customers as their own end-users may be located in multiple regions of the world. In addition, Exclusive Networks helps its customers through its expertise in vendor selection as cybersecurity and digital infrastructure solutions become ever more complicated and keep evolving in the face of increasing cybersecurity threats.

Enquiries

For additional information, please contact:

Media:

FTI Consulting

Jamie Ricketts, Christina Zinck, Emily Oliver, Charlotte Stephen

+44 (0)20 3727 1000 | [email protected]

Exclusive Networks

Hadas Hughes, VP Global Marketing and Communications

Hacene Boumendjel, Head of Investor Relations

Contact via [email protected]

Rationale for the IPO

The IPO mainly aims to support the Group’s development and growth strategy focused on:

- (i) Continuing to drive the underlying growth of existing vendors in current geographies;

- (ii) Adding new geographies for existing vendors;

- (iii) Attracting new vendors to its existing services and solutions offering;

- (iv) Expanding its services and solutions offering to serve customers’ needs; and

(v) Pursuing value-accretive M&A.

Final terms of the Offering

Price of the Offering

The price of the Offering is set at 20 euros per share.

This price implies a market capitalisation of Exclusive Networks of approximately 1.8 billion euros.

Size of the Offering

- • 13,000,000 new shares were issued by the Company, resulting in gross proceeds of approximately 260 million euros.

- • 5,295,307 existing shares were sold by Everest UK Holdco Limited (a Permira entity), HTIVB (a legal entity ultimately controlled by Olivier Breittmayer) and certain managers, employees and former employees of the Company, resulting in gross proceeds of approximately 106 million euros.

- • Sale of up to 2,744,296 additional existing shares (representing a maximum of 15.00% of the total number of shares offered in the Offering) by Everest UK Holdco Limited and HTIVB if the overallotment is exercised in full, resulting in additional gross proceeds of up to approximately 55 million euros. The over-allotment option is exercisable until 22 October 2021.

Out of the total number of shares offered in the Offering, 303,456 shares were allocated to the French public offering (OPO).

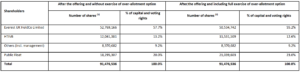

Evolution of the share capital

Upon completion of the reorganisation and of offering, Exclusive Networks’ shareholding structure will be as follows:

Free Float

Free float will represent approximately 20% of Exclusive Networks’ share capital post-Offering, and could increase to approximately 23% of Exclusive Networks’ share capital in case of full exercise of the over-allotment option.

Lock-up agreements

180 calendar days after the Offering Settlement Date for the Company, Everest UK Holdco Limited and HTIVB and 360 days after the Offering Settlement Date for the Managers, subject to certain exceptions.

Timetable of the Offer

Conditional trading of Exclusive Networks shares on the regulated market of Euronext Paris is expected to start on 23 September 2021 at 9:00 a.m. (Paris time).

Settlement and delivery of shares offered in the Offering is expected to occur on 27 September 2021.

Financial intermediaries

J.P. Morgan and Morgan Stanley are acting as Joint Global Coordinators and Joint Bookrunners.

BNP PARIBAS, Citigroup and Société Générale are acting as Joint Bookrunners.

Lazard is acting as independent financial advisor.

Publicly available information

Copies of the French prospectus that has been approved by the AMF on 14 September, 2021 under the number 21-399, consisting of (i) a registration document approved on 3 September, 2021 under the number I.21-044, (ii) the supplement to such registration document approved on 14 September 2021 under the number I.21-050, and (iii) a securities note and a summary of the French prospectus (included in the securities note), are available free of charge upon request to the company at Exclusive Networks, 20 quai du Point du Jour, 92100 Boulogne-Billancourt, as well as on the website of the AMF (www.amf-france.org) and Exclusive Networks (www.exclusive-networks-ir.com/ipo/).

The Company draws the public’s attention to the risk factors contained in Chapter 3 of the registration document and in Section 2 of the securities note. The occurrence of one or more of these risks may have a material adverse effect on the business, reputation, financial condition, results of operations or prospects of the Group, as well as on the market price of the Company’s shares.

Important Notice

This press release does not constitute a public offer to sell or purchase, or a public solicitation of an offer to sell or purchase, securities in the United States or in any other country or jurisdiction. Exclusive Networks shares may not be offered or sold in the United States absent registration or an exemption from registration under the U.S. Securities Act of 1933, as amended. Exclusive Networks does not intend to register in the United States any portion of the offering or to conduct a public offering of the shares in the United States.

No communication nor any information relating to the planned offering described in this press release or to Exclusive Networks may be distributed in any country or jurisdiction where such distribution would require registration or approval of securities. No such registration or approval has been or will be obtained outside of France. The distribution of this press release in certain countries may be prohibited under applicable law. Exclusive Networks assumes no responsibility if there is a violation of applicable law and regulation by any person.

This announcement is an advertisement and not a prospectus within the meaning of Regulation (EU) 2017/1129 of the European Parliament and of the Council of 14 June 2017 on the prospectus to be published when securities are offered to the public or admitted to trading on a regulated market, as amended (the “Prospectus Regulation”), also forming part of the domestic law in the United Kingdom by virtue of the European Union (Withdrawal) Act 2018 (the “EUWA”).

With respect to the member States of the European Economic Area and to the United Kingdom, no action has been undertaken or will be undertaken to make an offer to the public of the securities referred to herein requiring a publication of a prospectus in any relevant member State other than France. As a result, the shares may not and will not be offered in any relevant member State other than France except in accordance with the exemptions set forth in Article 1(4) of the Prospectus Regulation, or under any other circumstances which do not require the publication by Exclusive Networks of a prospectus pursuant to Article 3(2) of the Prospectus Regulation, also forming part of the domestic law in the United Kingdom by virtue of EUWA, and/or to applicable regulations of that relevant member State or the United Kingdom.

In France, an offer to the public of securities may not be made except pursuant to a prospectus that has been approved by the French Financial Markets Authority (the “AMF”). The approval of the prospectus by the AMF should not be understood as an endorsement of the securities offered or admitted to trading on a regulated market.Thes

This announcement is not a prospectus, a disclosure document or a product disclosure statement for the purposes of the Corporations Act 2001 (Cth) (“Corporations Act”). The provision of this announcement to any person does not constitute an offer of, or an invitation to apply for, any securities in Australia. This press release is intended for distribution to, and any offer in Australia of the securities of the Company may only be made to, persons who are “sophisticated investors” or “professional investors” within the meaning of section 708 of the Corporations Act, and who are a “wholesale client” within the meaning of section 761G of the Corporations Act.

In Canada, the information contained in this announcement is only addressed to and directed at persons who are accredited investors and permitted clients as defined in Canadian securities legislation.

During a period of 30 days following the date on which the offer price is determined (i.e., until October 22, 2021 (inclusive)), J.P. Morgan AG, acting as stabilising manager may, without any obligation, in compliance with laws and regulations in particular, in particular Regulation (EU) No. 59612014 of April 16, 2014 on market abuse and Commission Delegated Regulation (EU) No. 2016/1052 of March 8, 2016, effect transactions with a view to maintaining the market price of the Company’s shares on the regulated market of Euronext Paris. In compliance with Article 7 of Commission Delegated Regulation 2016/1052 of March 8, 2016, the stabilisation activities shall not in any circumstances be executed above the offer price. Such stabilisation activities may affect the price of the shares and may conduct to the fixing of the market price higher than the one which would otherwise be fixed. Even if stabilisation activities were carried out, J.P. Morgan AG may, at any time, decide to stop such activities. Information will be provided to the competent market authorities and the public in compliance with Article 6 of the above mentioned Regulation.

Information for distributors

Solely for the purposes of the product governance requirements contained within: (a) EU Directive 2014/65/EU on markets in financial instruments, as amended (“MiFID II”); (b) Articles 9 and 10 of Commission Delegated Directive (EU) 2017/593 supplementing MiFID II; and (c) local implementing measures (together, the “MiFID II Product Governance Requirements”), and disclaiming all and any liability, whether arising in tort, contract or otherwise, which any “manufacturer” (for the purposes of the MiFID II Product Governance Requirements) may otherwise have with respect thereto, the Shares have been subject to a product approval process, which has determined that such Shares are: (i) compatible with an end target market of retail investors and investors who meet the criteria of professional clients and eligible counterparties, each as defined in MiFID II; and (ii) eligible for distribution through all distribution channels as are permitted by MiFID II (the “Target Market Assessment”). Notwithstanding the Target Market Assessment, distributors should note that: the price of the Shares may decline and investors could lose all or part of their investment; the Shares offer no guaranteed income and no capital protection; and an investment in the Shares is compatible only with investors who do not need a guaranteed income or capital protection, who (either alone or in conjunction with an appropriate financial or other adviser) are capable of evaluating the merits and risks of such an investment and who have sufficient resources to be able to bear any losses that may result therefrom.

The Target Market Assessment is without prejudice to the requirements of any contractual, legal or regulatory selling restrictions in relation to the Offering.

For the avoidance of doubt, the Target Market Assessment does not constitute: (a) an assessment of suitability or appropriateness for the purposes of MiFID II; or (b) a recommendation to any investor or group of investors to invest in, or purchase, or take any other action whatsoever with respect to the Shares.Each distributor is responsible for undertaking its own target market assessment in respect of the Shares and determining appropriate distribution channels.

The contents of this announcement have been prepared by and are the sole responsibility of the Company.